Life Insurance

-

-

Homeowners Insurance

-

-

Homeowners Insurance

-

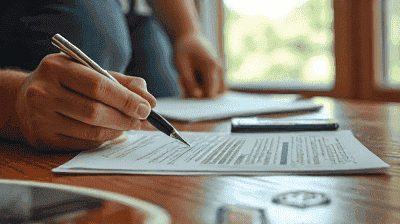

Renters Insurance

-

Liability Insurance